#International Business Valuation

Explore tagged Tumblr posts

Text

International Business Valuation | Wtpadvisors.com

With Wtpadvisors.com, you can unlock the genuine value of your international business. Our team of professionals offers a comprehensive range of business valuation services. Unlock your potential today.

International Business Valuation

0 notes

Text

Bridging the Gap: How Global Valuation Summit 2023 Connects Valuers and Financial Institutions

The valuation field has often functioned in a silo, separate from the larger financial ecosystem. The Global Valuation Summit 2023 aims to bridge this gap, connecting registered valuers with financial institutions. Here’s what you can look forward to.

Collaboration: The Need of the Hour

In today’s fast-paced financial world, isolated operations no longer make the cut. Valuers need to work in tandem with financial institutions to bring about more accurate, actionable market valuation figures.

The Forum for Dialogue

This global summit provides a unique platform for valuers and financial institutions to meet, network, and discuss collaboration. The focus will be on how valuers can contribute valuable data and insights to the financial sector.

The Role of International Standards

International valuation standards are an essential topic at the summit, especially considering the need for a common language between valuers and financial institutions. Ensuring alignment with these standards will enhance the credibility of a registered valuer organisation.

Why You Should Register Now

Given the summit’s focus on collaborative opportunities, registering early will help you prepare adequately. Register now for the Global Valuation Summit, and ensure you don’t miss this unprecedented opportunity for growth and networking.

Final Take

Whether you’re looking to understand the integration of ESG into valuation or searching for collaborative opportunities with financial institutions, the Global Valuation Summit 2023 is the event to attend. How to register for the Global Valuation Summit is well-documented and easy to follow, so don’t miss out on this opportunity to grow and network with like-minded professionals in the industry.

Mark your calendars for this monumental world summit 2023 and global summit 2023 event, as it promises to bring unprecedented value (literally and metaphorically) to registered valuers across the globe. Register here: https://www.globalvaluationsummit.com/register

#global business summit#Gvs#registered valuers#international valuation standards#market valuation#Register now For the Global valuation summit

0 notes

Text

@oakfern replied to your post “it's going to be fun to watch the realization...”:

i feel like this is going to play out very similarly to voice assistants. there was a huge boom in ASR research, the products got a lot of hype, and they actually sold decently (at least alexa did). but 10 years on, they've been a massive failure, costing way more than they ever made back. even if ppl do think chatbot search engines are exciting and cool, it's not going to bring in more users or sell more products, and in the end it will just be a financial loss

(Responding to this a week late)

I don't know much about the history of voice assistants. Are there any articles you recommend on the topic? Sounds interesting.

ETA: Iater, I found and read this article from Nov 2022, which reports that Alexa and co. still can't turn a profit after many years of trying.

But anyway, yeah... this is why I don't have a strong sense of how widespread/popular these "generative AI" products will be a year or two from now. Or even five years from now.

(Ten years from now? Maybe we can trust the verdict will be in at that point... but the tech landscape of 2033 is going to be so different from ours that the question "did 'generative AI' take off or not?" will no doubt sound quaint and irrelevant.)

Remember when self-driving cars were supposed to be right around the corner? Lots of people took this imminent self-driving future seriously.

And I looked at it, and thought "I don't get it, this problem seems way harder than people are giving it credit for. And these companies show no signs of having discovered some clever proprietary way forward." If people asked me about it, that's what I would say.

But even if I was sure that self-driving cars wouldn't arrive on schedule, that didn't give me much insight into the fate of "self-driving cars," the tech sector meme. It wasn't like there was some specific deadline, and when we crossed it everyone was going to look up and say "oh, I guess that didn't work, time to stop investing."

The influx of capital -- and everything downstream from it, the trusting news stories, the prominence of the "self-driving car future" in the public mind, the seriousness which it was talked about -- these things went on, heedless of anything except their own mysterious internal logic.

They went on until . . . what? The pandemic, probably? I actually still don't know.

Something definitely happened:

In 2018 analysts put the market value of Waymo LLC, then a subsidiary of Alphabet Inc., at $175 billion. Its most recent funding round gave the company an estimated valuation of $30 billion, roughly the same as Cruise. Aurora Innovation Inc., a startup co-founded by Chris Urmson, Google’s former autonomous-vehicle chief, has lost more than 85% since last year [i.e. 2021] and is now worth less than $3 billion. This September a leaked memo from Urmson summed up Aurora’s cash-flow struggles and suggested it might have to sell out to a larger company. Many of the industry’s most promising efforts have met the same fate in recent years, including Drive.ai, Voyage, Zoox, and Uber’s self-driving division. “Long term, I think we will have autonomous vehicles that you and I can buy,” says Mike Ramsey, an analyst at market researcher Gartner Inc. “But we’re going to be old.”

Whatever killed the "self-driving car" meme, though, it wasn't some newly definitive article of proof that the underlying ideas were flawed. The ideas never made sense in the first place. The phenomenon was not really about the ideas making sense.

Some investors -- with enough capital, between them, to exert noticable distortionary effects on entire business sectors -- decided that "self-driving cars" were, like, A Thing now. And so they were, for a number of years. Huge numbers of people worked very hard trying to make "self-driving cars" into a viable product. They were paid very well to do. Talent was diverted away from other projects, en masse, into this effort. This went on as long as the investors felt like sustaining it, and they were in no danger of running out of money.

Often the "tech sector" feels less like a product of free-market incentives than it does like a massive, weird, and opaque public works product, orchestrated by eccentrics like Masayoshi Son, and ultimately organized according to the aesthetic proclivities and changing moods of its architects, not for the purpose of "doing business" in the conventional sense.

Gig economy delivery apps (Uber Eats, Doordash, etc.) have been ubiquitous for years, and have reported huge losses in every one of those years.

This entertaining post from 2020 about "pizza arbitrage" asks:

Which brings us to the question - what is the point of all this? These platforms are all losing money. Just think of all the meetings and lines of code and phone calls to make all of these nefarious things happen which just continue to bleed money. Why go through all this trouble?

Grubhub just lost $33 million on $360 million of revenue in Q1.

Doordash reportedly lost an insane $450 million off $900 million in revenue in 2019 (which does make me wonder if my dream of a decentralized network of pizza arbitrageurs does exist).

Uber Eats is Uber's "most profitable division” 😂😂. Uber Eats lost $461 million in Q4 2019 off of revenue of $734 million. Sometimes I need to write this out to remind myself. Uber Eats spent $1.2 billion to make $734 million. In one quarter.

And now, in February 2023?

DoorDash's total orders grew 27% to 467 million in the fourth quarter. That beat Wall Street’s forecast of 459 million, according to analysts polled by FactSet. Fourth quarter revenue jumped 40% to $1.82 billion, also ahead of analysts’ forecast of $1.77 billion.

But profits remain elusive for the 10-year-old company. DoorDash said its net loss widened to $640 million, or $1.65 per share, in the fourth quarter as it expanded into new categories and integrated Wolt into its operations.

Do their investors really believe these companies are going somewhere, and just taking their time to get there? Or is this more like a subsidy? The lost money (a predictable loss in the long term) merely the price paid for a desired good -- for an intoxicating exercise of godlike power, for the chance to reshape reality to one's whims on a large scale -- collapsing the usual boundary between self and outside, dream and reality? "The gig economy is A Thing, now," you say, and wave your hand -- and so it is.

Some people would pay a lot of money to be a god, I would think.

Anyway, "generative AI" is A Thing now. It wasn't A Thing a year ago, but now it is. How long will it remain one? The best I can say is: as long as the gods are feeling it.

480 notes

·

View notes

Text

this is something to think about

now i did get this from grok i would like to point out that he is a "special government employee" whatever the hell that means. he does still have to abide the conflict of interest laws that say he cant be involved in government activities that can result in direct financial benefit. this proves that he is currently breaking this. because he has not stepped aside nor reassigned rights while he works for the government. i would also like to point out the crazy irony that his company receives incentives and help for lack of a better word from two states his friend has major beef with lol sorry.

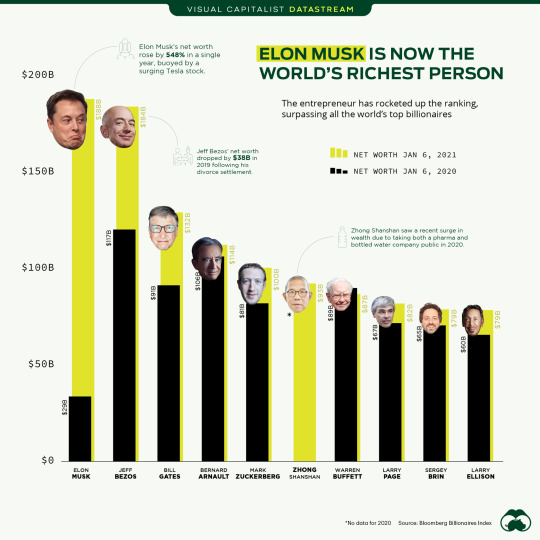

Elon Musk's companies, particularly Tesla and SpaceX, have indeed received what can be described as government "welfare" or support in various forms:

Tesla:

EV Tax Credits: Tesla vehicles qualified for federal tax credits designed to incentivize electric vehicle purchases. This was not a direct payment to Tesla but reduced the cost for consumers, indirectly benefiting Tesla's sales.

State and Local Incentives: Tesla has received numerous incentives from states like Nevada, New York, and California for factory construction and operations, including tax abatements and grants.

Loans: Tesla benefited from a DOE loan in its early days to help build its first manufacturing facility, which was paid back with interest ahead of schedule.

SpaceX:

NASA Contracts: SpaceX has secured billions in contracts from NASA, primarily for cargo and crew transport services to the International Space Station. These contracts have been crucial to SpaceX's growth.

Military and Other Government Contracts: SpaceX has also received contracts from the U.S. Department of Defense and other agencies for satellite launches and other space services.

Direct Benefits to Musk: While these subsidies and contracts go directly to his companies, they:

Boost company profitability and valuation, thereby increasing Musk's wealth through his ownership stakes.

Provide a form of indirect benefit to Musk by supporting the companies he leads, which in turn can affect his personal income through stock options, bonuses, or salary adjustments based on company performance.

Musk's Public Stance: Musk has publicly stated that his companies earn government contracts because they offer competitive products at lower costs, positioning this as a merit-based system rather than welfare. However, the reality is that government support through contracts, grants, and tax incentives has played a significant role in the growth of his companies.

Criticism: Critics argue that these benefits constitute corporate welfare, especially given Musk's wealth and the narrative of being a self-made entrepreneur. There's a debate over whether such support skews market dynamics in favor of already large companies.

In Summary: Elon Musk's companies have received substantial government support, which in turn supports his personal financial success. This support includes tax credits, direct contracts, and various forms of incentives that, while not personal welfare to Musk, significantly aid his businesses. This is a nuanced situation where government involvement is seen both as necessary support for innovation and as corporate welfare by different viewpoints.

#donald trump#president trump#trump#trump 2024#trump vance 2024#trump vs harris#2024 presidential election#presidential debate#civil rights#human rights#elon musk#trump tariffs#us tariffs#doge#musk#us congress#usaid#coup

7 notes

·

View notes

Text

🌍 🏦💵 🚨

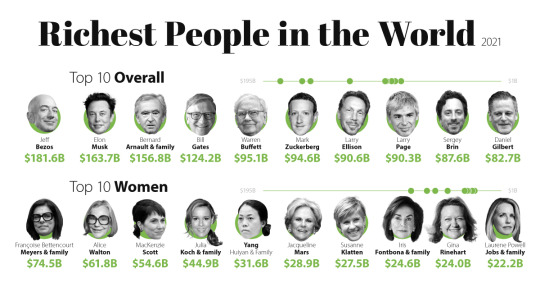

FIVE RICHEST BILLIONAIRES DOUBLE THEIR WEALTH SINCE 2020 WHILE 5 BILLION ARE MADE POORER

Oxfam International, a British-founded International Charitable organization based in Nairobi, Kenya, says the world's richest people have managed to double their wealth since 2020, as 5 billion people are made poorer as a result of a "decade of division."

Oxfam made the claims in a press release on its recently published report released Monday, January 15th on inequality and global corporate power called "Inequality Inc."

According to Oxfam, the world's richest people have more than doubled their wealth from $405 billion to $869 billion since 2020, a rate equivelent to $14 million per hour, while approximately 5 billion people have been made poorer in the same time period.

"If current trends continue," the statement says, "the world will have its first trillionaire within a decade but poverty won't be eradicated for another 229 years."

Oxfam looks to the Davos gathering of the world's largest corporations, pointing to the valuations of the top ten largest companies, together worth more than $10.2 trillion.

“We’re witnessing the beginnings of a decade of division, with billions of people shouldering the economic shockwaves of pandemic, inflation and war, while billionaires’ fortunes boom. This inequality is no accident; the billionaire class is ensuring corporations deliver more wealth to them at the expense of everyone else,” Oxfam's International interim Executive Director Amitabh Behar is quoted as saying.

“Runaway corporate and monopoly power is an inequality-generating machine: through squeezing workers, dodging tax, privatizing the state, and spurring climate breakdown, corporations are funneling endless wealth to their ultra-rich owners. But they’re also funneling power, undermining our democracies and our rights. No corporation or individual should have this much power over our economies and our lives —to be clear, nobody should have a billion dollars”.

According to Oxfam, Billionaires increased their wealth by $3.3 trillion since 2020, a growth rate three times faster than inflation.

Oxfam adds that, despite representing just 21% of the global population, the countries of the Global North own 69% of global wealth, with Global North countries home to 74% of global billionaire wealth.

Further, the top 1% own 43% of all global financial assets, with billionaires owning 48% of wealth in the Middle East, 50% in Asia, and 47% in Europe.

In addition to overall wealth, 148 of the world's largest corporations raked in $1.8 trillion in total net profits, a 52% increase over the period from 2018-2021.

Corporate windfalls increased to nearly $700 billion, with the report finding that for every $100 in profits made by the top 96 major corporations between July 2022 and June 2023, $82 was paid out to wealthy shareholders.

Oxfam International interim Executive Director Amitabh Behar says that “Monopolies harm innovation and crush workers and smaller businesses. The world hasn’t forgotten how pharma monopolies deprived millions of people of COVID-19 vaccines, creating a racist vaccine apartheid, while minting a new club of billionaires."

The Oxfam press release goes on to point our that people are working harder and for longer, often for poverty wages in unsafe jobs, adding that the wages of nearly 800 million people have not kept up with inflation, losing $1.5 trillion in value over the last two years, the equivalent of nearly a month's lost wages for each individual worker.

Oxfam also found that, of the 1'600 largest companies, less than 0.4% of them are publicly committed to paying employees a living wage.

Oxfam shows how a "war on taxation" by large corporations has pushed the effective tax rates on corporations to fall by a third in recent decades, while relentless privitization of public services like education and water services have expanded massively.

“We have the evidence. We know the history. Public power can rein in runaway corporate power and inequality —shaping the market to be fairer and free from billionaire control. Governments must intervene to break up monopolies, empower workers, tax these massive corporate profits and, crucially, invest in a new era of public goods and services,” said Behar.

“Every corporation has a responsibility to act but very few are. Governments must step up. There is action that lawmakers can learn from, from US anti-monopoly government enforcers suing Amazon in a landmark case, to the European Commission wanting Google to break up its online advertising business, and Africa’s historic fight to reshape international tax rules.”

Oxfam offers three notes on how governments can rectify the situation, including the following:

🔹 Revitalizing the state. A dynamic and effective state is the best bulwark against extreme corporate power. Governments should ensure universal provision of healthcare and education, and explore publicly-delivered goods and public options in sectors from energy to transportation.

🔹 Reining in corporate power, including by breaking up monopolies and democratizing patent rules. This also means legislating for living wages, capping CEO pay, and new taxes on the super-rich and corporations, including permanent wealth and excess profit taxes. Oxfam estimates that a wealth tax on the world’s millionaires and billionaires could generate $1.8 trillion a year.

🔹 Reinventing business. Competitive and profitable businesses don’t have to be shackled by shareholder greed. Democratically-owned businesses better equalize the proceeds of business. If just 10 percent of US businesses were employee-owned, this could double the wealth share of the poorest half of the US population, including doubling the average wealth of Black households.

#source

@WorkerSolidarityNews

#inequality#wealth inequality#us news#us wealth#global inequality#wealth#capitalism#billionaires#richest people#politics#news#geopolitics#world news#global news#international news#global politics#world politics#international politics#international#international affairs#united states#davos#wef#world economic forum#billionaire#wealth accumulation#imperialism#us imperialism#western imperialism#socialism

34 notes

·

View notes

Text

While the finer points of running a social media business can be debated, one basic truth is that they all run on attention. Tech leaders are incentivized to grow their user bases so there are more people looking at more ads for more time. It’s just good business.

As the owner of Twitter, Elon Musk presumably shared that goal. But he claimed he hadn’t bought Twitter to make money. This freed him up to focus on other passions: stopping rival tech companies from scraping Twitter’s data without permission—even if it meant losing eyeballs on ads.

Data-scraping was a known problem at Twitter. “Scraping was the open secret of Twitter data access. We knew about it. It was fine,” Yoel Roth wrote on the Twitter alternative Bluesky. AI firms in particular were notorious for gobbling up huge swaths of text to train large language models. Now that those firms were worth a lot of money, the situation was far from fine, in Musk’s opinion.

In November 2022, OpenAI debuted ChatGPT, a chatbot that could generate convincingly human text. By January 2023, the app had over 100 million users, making it the fastest growing consumer app of all time. Three months later, OpenAI secured another round of funding that closed at an astounding valuation of $29 billion, more than Twitter was worth, by Musk’s estimation.

OpenAI was a sore subject for Musk, who’d been one of the original founders and a major donor before stepping down in 2018 over disagreements with the other founders. After ChatGPT launched, Musk made no secret of the fact that he disagreed with the guardrails that OpenAI put on the chatbot to stop it from relaying dangerous or insensitive information. “The danger of training AI to be woke—in other words, lie—is deadly,” Musk said on December 16, 2022. He was toying with starting a competitor.

Near the end of June 2023, Musk launched a two-part offensive to stop data scrapers, first directing Twitter employees to temporarily block “logged out view.” The change would mean that only people with Twitter accounts could view tweets.

“Logged out view” had a complicated history at Twitter. It was rumored to have played a part in the Arab Spring, allowing dissidents to view tweets without having to create a Twitter account and risk compromising their anonymity. But it was also an easy access point for people who wanted to scrape Twitter data.

Once Twitter made the change, Google was temporarily blocked from crawling Twitter and serving up relevant tweets in search results—a move that could negatively impact Twitter’s traffic. “We’re aware that our ability to crawl Twitter.com has been limited, affecting our ability to display tweets and pages from the site in search results,” Google spokesperson Lara Levin told The Verge. “Websites have control over whether crawlers can access their content.” As engineers discussed possible workarounds on Slack, one wrote: “Surely this was expected when that decision was made?”

Then engineers detected an “explosion of logged in requests,” according to internal Slack messages, indicating that data scrapers had simply logged in to Twitter to continue scraping. Musk ordered the change to be reversed.

On July 1, 2023, Musk launched part two of the offensive. Suddenly, if a user scrolled for just a few minutes, an error message popped up. “Sorry, you are rate limited,” the message read. “Please wait a few moments then try again.”

Rate limiting is a strategy that tech companies use to constrain network traffic by putting a cap on the number of times a user can perform a specific action within a given time frame (a mouthful, I know). It’s often used to stop bad actors from trying to hack into people’s accounts. If a user tries an incorrect password too many times, they see an error message and are told to come back later. The cost of doing this to someone who has forgotten their password is low (most people stay logged in), while the benefit to users is very high (it prevents many people’s accounts from getting compromised).

Except, that wasn’t what Musk had done. The rate limit that he ordered Twitter to roll out on July 1 was an API limit, meaning Twitter had capped the number of times users could refresh Twitter to look for new tweets and see ads. Rather than constrain users from performing a specific action, Twitter had limited all user actions. “I realize these are draconian rules,” a Twitter engineer wrote on Slack. “They are temporary. We will reevaluate the situation tomorrow.”

At first, Blue subscribers could see 6,000 posts a day, while nonsubscribers could see 600 (enough for just a few minutes of scrolling), and new nonsubscriber accounts could see just 300. As people started hitting the limits, #TwitterDown started trending on, well, Twitter. “This sucks dude you gotta 10X each of these numbers,” wrote user @tszzl.

The impact quickly became obvious. Companies that used Twitter direct messages as a customer service tool were unable to communicate with clients. Major creators were blocked from promoting tweets, putting Musk’s wish to stop data scrapers at odds with his initiative to make Twitter more creator friendly. And Twitter’s own trust and safety team was suddenly stopped from seeing violative tweets.

Engineers posted frantic updates in Slack. “FYI some large creators complaining because rate limit affecting paid subscription posts,” one said.

Christopher Stanley, the head of information security, wrote with dismay that rate limits could apply to people refreshing the app to get news about a mass shooting or a major weather event. “The idea here is to stop scrapers, not prevent people from obtaining safety information,” he wrote. Twitter soon raised the limits to 10,000 (for Blue subscribers), 1,000 (for nonsubscribers), and 500 (for new nonsubscribers). Now, 13 percent of all unverified users were hitting the rate limit.

Users were outraged. If Musk wanted to stop scrapers, surely there were better ways than just cutting off access to the service for everyone on Twitter.

“Musk has destroyed Twitter’s value & worth,” wrote attorney Mark S. Zaid. “Hubris + no pushback—customer empathy—data = a great way to light billions on fire,” wrote former Twitter product manager Esther Crawford, her loyalties finally reversed.

Musk retweeted a joke from a parody account: “The reason I set a ‘View Limit’ is because we are all Twitter addicts and need to go outside.”

Aside from Musk, the one person who seemed genuinely excited about the changes was Evan Jones, a product manager on Twitter Blue. For months, he’d been sending executives updates regarding the anemic signup rates. Now, Blue subscriptions were skyrocketing. In May, Twitter had 535,000 Blue subscribers. At $8 per month, this was about $4.2 million a month in subscription revenue. By early July, there were 829,391 subscribers—a jump of about $2.4 million in revenue, not accounting for App Store fees.

“Blue signups still cookin,” he wrote on Slack above a screenshot of the signup dashboard.

Jones’s team capitalized on the moment, rolling out a prompt to upsell users who’d hit the rate limit and encouraging them to subscribe to Twitter Blue. In July, this prompt drove 1.7 percent of the Blue subscriptions from accounts that were more than 30 days old and 17 percent of the Blue subscriptions from accounts that were less than 30 days old.

Twitter CEO Linda Yaccarino was notably absent from the conversation until July 4, when she shared a Twitter blog post addressing the rate limiting fiasco, perhaps deliberately burying the news on a national holiday.

“To ensure the authenticity of our user base we must take extreme measures to remove spam and bots from our platform,” it read. “That’s why we temporarily limited usage so we could detect and eliminate bots and other bad actors that are harming the platform. Any advance notice on these actions would have allowed bad actors to alter their behavior to evade detection.” The company also claimed the “effects on advertising have been minimal.”

If Yaccarino’s role was to cover for Musk’s antics, she was doing an excellent job. Twitter rolled back the limits shortly after her announcement. On July 12, Musk debuted a generative AI company called xAI, which he promised would develop a language model that wouldn’t be politically correct. “I think our AI can give answers that people may find controversial even though they are actually true,” he said on Twitter Spaces.

Unlike the rival AI firms he was trying to block, Musk said xAI would likely train on Twitter’s data.

“The goal of xAI is to understand the true nature of the universe,” the company said grandly in its mission statement, echoing Musk’s first, disastrous town hall at Twitter. “We will share more information over the next couple of weeks and months.”

In November 2023, xAI launched a chatbot called Grok that lacked the guardrails of tools like ChatGPT. Musk hyped the release by posting a screenshot of the chatbot giving him a recipe for cocaine. The company didn’t appear close to understanding the nature of the universe, but per haps that’s coming.

Excerpt adapted from Extremely Hardcore: Inside Elon Musk’s Twitter by Zoë Schiffer. Published by arrangement with Portfolio Books, a division of Penguin Random House LLC. Copyright © 2024 by Zoë Schiffer.

20 notes

·

View notes

Text

MicroStrategy & Corporate Bitcoin Adoption: Is This the Start of a Trend?

When MicroStrategy made its first Bitcoin purchase in August 2020, many dismissed it as an eccentric move by its outspoken CEO, Michael Saylor. Fast forward to today, and the company has become the largest publicly traded holder of Bitcoin, with billions of dollars converted from cash reserves into digital gold. What started as an outlier decision now looks more like the beginning of a broader shift in corporate finance.

But why are big companies buying Bitcoin, and what does this signal for the future of business and finance?

Why Corporations Are Buying Bitcoin

Historically, companies have held cash reserves in banks, government bonds, or other low-risk assets. This strategy worked well when inflation was low, and the dollar remained relatively stable. But over the past few years, the financial landscape has changed dramatically. Governments worldwide have ramped up money printing, leading to concerns over currency debasement. With inflation eating away at purchasing power, sitting on cash has become an increasingly bad idea.

Bitcoin presents an alternative. Unlike fiat currencies, which can be endlessly printed, Bitcoin has a fixed supply of 21 million coins. This scarcity makes it a hedge against inflation and currency devaluation, much like gold but with superior portability, liquidity, and security.

For MicroStrategy, the logic was simple: keeping cash in dollars meant losing value over time, while holding Bitcoin offered long-term appreciation potential. Their gamble paid off, with the company's Bitcoin holdings significantly appreciating, boosting their overall market valuation.

The Ripple Effect: Who’s Following MicroStrategy’s Lead?

MicroStrategy’s aggressive Bitcoin strategy has influenced other corporations to take notice. Tesla, led by Elon Musk, briefly bought Bitcoin for its balance sheet, though it later sold a portion. Block (formerly Square), owned by Jack Dorsey, has also been a strong advocate, integrating Bitcoin into its business model.

Now, we’re seeing institutional adoption growing beyond just tech companies. Major financial firms like BlackRock and Fidelity have started offering Bitcoin-related investment products, and traditional banks are scrambling to provide crypto services to high-net-worth clients.

Even Microsoft, one of the world’s largest companies, is facing internal shareholder pressure to consider adding Bitcoin to its reserves. While not all businesses will go as far as MicroStrategy, the idea of holding Bitcoin as a treasury asset is becoming less radical by the day.

What This Signals for the Future

MicroStrategy’s moves have sparked a crucial conversation about how companies manage their financial reserves. If more corporations adopt Bitcoin, it could significantly change global finance:

New Standard for Treasury Reserves – If Bitcoin becomes a widely accepted reserve asset, businesses will no longer be tied to the traditional financial system’s limitations.

Increased Stability and Legitimacy for Bitcoin – Corporate adoption reduces volatility and strengthens Bitcoin’s position as a reliable asset.

Pressure on Governments and Regulators – The more companies hold Bitcoin, the harder it becomes for governments to ignore or attempt to ban it.

Some argue that Bitcoin’s volatility makes it a risky bet for corporations. However, volatility is a feature of any emerging asset. As adoption increases, the market will likely stabilize, making Bitcoin even more attractive for long-term holding.

Conclusion

What started as MicroStrategy’s bold experiment is now looking more like the early stages of a financial transformation. More companies are recognizing that Bitcoin isn’t just a speculative asset—it’s a long-term hedge against a failing fiat system. If this trend continues, we could see a future where holding Bitcoin on the balance sheet isn’t just an option for corporations—it’s a necessity.

The question is no longer if more companies will follow MicroStrategy’s lead, but when.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#MicroStrategy#CorporateFinance#CryptoAdoption#FinancialRevolution#BitcoinTreasury#HODL#DigitalGold#InflationHedge#CryptoInvesting#SoundMoney#FutureOfFinance#Blockchain#FiatCollapse#BTC#BitcoinNews#MoneyEvolution#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#financial experts#unplugged financial#cryptocurrency

2 notes

·

View notes

Text

Mergers & Acquisitions in Thailand

Thailand has witnessed a surge in mergers and acquisitions (M&As) activity in recent years, driven by various economic factors and strategic considerations. This trend has been fueled by both domestic and international companies seeking to expand their operations, gain market share, and capitalize on the country's economic growth.

Key Drivers of M&A Activity in Thailand

Economic Growth: Thailand's robust economic growth, coupled with its strategic location in Southeast Asia, has made it an attractive destination for foreign investors.

Favorable Government Policies: The Thai government has implemented supportive policies to encourage foreign investment, including tax incentives and streamlined regulatory processes.

Rising Consumer Spending: The growing middle class in Thailand has led to increased consumer spending, creating opportunities for businesses in various sectors.

Strategic Acquisitions: Companies are seeking to acquire businesses with complementary products, services, or distribution networks to enhance their market position.

Synergy Benefits: Mergers and acquisitions can create synergies by combining resources, expertise, and customer bases, leading to cost reductions and revenue growth.

Popular Sectors for M&A Activity

Automotive: The Thai automotive industry has been a major target for M&A activity, with both domestic and international players seeking to expand their manufacturing capabilities and market share.

Real Estate: The booming real estate sector in Thailand has attracted significant investment, with foreign companies acquiring properties and developing projects.

Energy: The energy sector has been another focus of M&A activity, as companies look to secure access to resources and expand their operations in the region.

Technology: The technology sector has seen a rise in M&A deals, driven by the increasing demand for digital solutions and services.

Consumer Goods: The consumer goods sector has been a popular target for M&A activity, with companies seeking to tap into the growing Thai market and expand their product offerings.

Challenges and Considerations

While Thailand offers numerous opportunities for M&A activity, there are also challenges to be considered. These include:

Regulatory Framework: Navigating the regulatory landscape can be complex, requiring careful consideration of legal and compliance issues.

Cultural Differences: Understanding and adapting to cultural differences is essential for successful M&A transactions.

Due Diligence: Conducting thorough due diligence is crucial to identify potential risks and ensure a smooth integration process.

Valuation: Accurately valuing target companies can be challenging, especially in emerging markets.

Despite these challenges, Thailand's M&A market is expected to continue to grow in the coming years, driven by favorable economic conditions and increasing foreign investment. As the country's economy expands and its market becomes more sophisticated, M&A activity will likely play an even more significant role in shaping its business landscape.

#thailand#Mergers & Acquisitions in Thailand#corporate in thailand#corporate lawyers in thailand#lawyers in thailand

2 notes

·

View notes

Text

What is Private Banking? – Definition and How It Works

Some people amass significant wealth through business ventures or inherited multi-generational assets. The criteria to categorize them as “high-net-worth individuals” might vary across geographies. However, they require unique financial services like private banking and investment research outsourcing. This post will describe how private banking firms work.

What is Private Banking?

Private banking offers numerous wealth management, accounting, risk assessment, financial modeling, and property valuation services customized for high-net-worth individuals (HNWIs). Different firms and banks enable their HNWI clients to create investment strategies using private banking services.

Relationship managers and private bankers serve clients exclusively, supervising all financial aspects concerning the client’s real estate investments, gold possessions, and investor portfolio. They also monitor how different public policies and market trends affect the risks associated with an HNWI’s wealth.

Moreover, retirement planning is essential to private banking services because of the distinct lifestyle followed by high-net-worth individuals. Professional firms and private banks also plan the transfer of wealth involving family members, donations, and inheritance.

How Does Private Banking Work?

Private bankers and consulting relationship managers are responsible for strategically allocating the capital resources made available by HNWI clients. They can benefit from investment research outsourcing to streamline their portfolio management strategies.

Each private banking client has 1 million USD as investable assets. Therefore, managing all the financial operations via systematic investment decisions and advanced accounting tools are some essential duties of private banking professionals.

Their revenue depends on the performance of assets, agreed-upon commission rates, and offered services. When clients have more than 10 million USD, they are Ultra-HNWI. So, more precise risk management and investment research reporting become critical to the financial service providers at a private bank.

Benefits of Private Banking

1| Confidential Transactions

Private banks prioritize protecting the privacy of clients, managers, dealers, and marketing personnel. They allow HNWI to conduct secure transactions involving large sums of money using proprietary mechanisms.

Remember how celebrities, international sports athletes, and some industrialists prefer personalized treatment while building networks to enhance their social and financial status. They do not want public attention or the retail banking environment to manage their assets. Therefore, privacy is important to them.

2| Minimized Human Risks and Convenient Access

HNWI and Ultra-HNWI interact with the relationship manager or private banker who manages all other investment research outsourcing activities and banking interactions. So, wealthy individuals reduce the human risk of intelligence leakage or fraud by letting a single person control their assets on their behalf.

If an HNWI interacts with multiple people, everyone in the communication chain will know about the HNWI and share this information with third parties. The benefits of private banking services include mitigating such dangers.

3| Personalized Investment Opportunities

Private banks offer discounts and other pricing optimizations to ensure that high-net-worth clients stay with them instead of switching to another service provider. For example, private bankers might provide you with more generous interest rates to facilitate a beneficial mortgage.

Besides, clients engaged in international business are better positioned to acquire advantageous foreign exchange rates. Specialized lines of credit (LOC) can become available to the HNWI using private banks for wealth expansion.

Conclusion

Individuals who own investable assets that surpass 1 million USD in valuation reports demand tailored financial products and services. Simultaneously, investment research outsourcing teams assist their relationship managers and private bankers in strategizing portfolio development.

The service fees charged by private banks vary across wealth reporting, risk management, legal compliance audits, real estate services, and inheritance. However, HNWIs and UHNWIs pay the fees to enjoy the increased privacy and convenience of large transactions.

A leader in private banking services, SG Analytics supports worldwide private banks in devising research-backed investment ideas and strategies to maximize returns. Contact us today to get extensive insights into coverage expansion and the screening process.

3 notes

·

View notes

Text

Are you aware of US CPA Exam changes from 2024?

US CPA is one of the most lucrative career options in the accounting field. The global demand for CPAs has increased exponentially over the last few years. Parallelly, the roles and responsibilities of CPAs have also varied in accordance with the ever-changing business landscape. The advent of digitization and the implementation of new technologies have revolutionized the finance and accounting industry. To ensure that CPAs are updated and competent with the technology-driven business landscape, AICPA has introduced the CPA Evolution Initiative.

The US CPA Exam Evolution Initiative will come into effect from January 1, 2024 and will have significant changes to the CPA curriculum. The passage below explores in detail the CPA 2024 changes.

CPA Evolution Initiative – What is the New Model?

The new model has been proposed to make the CPAs more tech competent. The new model will follow a Core + Discipline model with 3 Core Sections and 3 Discipline Sections.

CPA students have to study all three core sections. The three core sections are:

Financial Auditing and Reporting (FAR)

Auditing and Attestation (AUD)

Taxation and Regulation (REG)

CPA students can choose one discipline section out of the three. The three discipline sections are:

Business analysis and reporting (BAR)

Information systems and controls (ISC)

Tax compliance and planning (TCP)

Irrespective of the discipline section the CPA candidate chooses, he can opt to practice in other areas well. His choice of discipline section will not have any effect on his CPA licensure.

Transition Policy – What it Means to CPA Aspirants?

AICPA along with NASBA, have created a smooth transition policy for implementing the new changes. The transition policy is simple and straightforward. Below is the break of the transition policy and how it affects the CPA candidates.

Candidates who have passed and have credit for AUD, FAR, or REG on the current CPA Exam will not need to take the corresponding new core section of AUD, FAR, or REG on the 2024 CPA Exam.

Candidates who have passed and have credit for BEC on the current CPA Exam will not need to take any of the three discipline sections.

Candidates without credit for AUD after Dec 31, 2023, will have to take the AUD core section on the 2024 CPA Exam.

Candidates without credit for FAR after Dec 31, 2023, will have to take the FAR core section on the 2024 CPA Exam.

Candidates without credit for REG after Dec 31, 2023, will have to take the REG core section on the 2024 CPA Exam.

Candidates without credit for BEC after Dec 31,2023 will have to take one Discipline section on the 2024 CPA Exam.

The current sections and curriculum of the CPA exam will not be available for testing after Dec 2023.

CPA Exam 2024 – What are the Content Changes?

There are some significant changes in the curriculum of each section for the CPA exam 2024. The content from the section has been transferred to the other sections.

The only section that remains relatively unchanged is AUD. While no content has been removed from it, some content from BEC has been added to this section. The newly added topics in the AUD section are basic economic concepts and business processes and internal controls. Some existing content from FAR will be moved to the BAR discipline section under the new model. These topics include business combinations, R&D costs, stock compensation, and public company reporting, among many others. Some BEC topics have also been moved to the FAR section. Similarly, some existing REG content has been moved to the TCP discipline section. This content includes gross income concepts.

In the case of discipline sections, the BAR section includes complex technical accounting topics along with lease accounting and revenue recognition. It also includes certain topics from the BEC section such as managerial and cost accounting, variance analysis, non-financial measures of performance, and financial valuation decision models. ISC exam section will evaluate the candidate on knowledge of IT audit and advisory services. It also borrows some BEC topics. Lastly, the TCP discipline section evaluates the candidates on knowledge of federal tax compliance policies and focuses on complex tasks. As specified already, some REG topics have been included in the TCP section.

Below is the summary of how the content has been spread across different sections under the CPA 2024 model:

REG – REG + TCP

FAR – FAR + BAR

AUD – AUD

BEC – FAR + BAR + AUD + ISC

CPA Exam 2024 – Scoring Weight Changes

There is not much change in the scoring weight of the CPA exam. Under the new model, every section has a scoring weight of 50% MCQs and 50% TBSs, except one section. The ISC discipline section gives 60% weightage to MCQs and 40% weightage to TBSs.

CPA Exam 2024 – Section Time and Question Count Changes

There is no change in the section time. The current section time of 4 hours will remain the same for the new model as well. In the case of question count, the new model has 2 changes. The current model has a question count in the range of 62-72 MCQs and 8 Sims, except for BEC. The BEC exam has 4 TBSs and 3 Written Communication questions. Under the new model, the ISC exam section will have 82 MCQs and 6 TBSs. Similarly, FAR and BAR exam sections will have 50 MCQs and 7 TBSs

CPA Exam 2024 – Skill Level Changes

There are no changes in the skill level categories but there are a few minor changes in the skill level allocation for some sections. The changes to the question count also reflect the skill level changes. For instance, ISC with more MCQs has more skill allocation to Remembering and Understanding. AUD section lays more emphasis at Remembering and Understanding and Analysis levels, whereas FAR section lays emphasis at Remembering and Understanding and Application levels. The latter section has fewer questions at the Analysis level.

REG section retains the same skill level with no changes. FAR and BAR have more questions at the application level with MCQs having complex calculations. TCP section contains the highest percentage of questions at the Application level.

It should be noted that these changes are not finalized. There might be a few changes to the new model. But, the core concept of the model will remain the same. AICPA has announced that it is waiting for inputs on the new model till September 30, 2022. Post that, it will review the comments and make any changes if deemed fit. The blueprint will be finalized in December 2022 and will be published in January 2023.

2 notes

·

View notes

Text

What Is The Trend Among Indian CFA Applicants?

The number of Indian candidates applying for the Chartered Financial Analyst cfa level 1 exams has increased, which can only be described as an emerging trend.

Right now, India positions third with the most number of competitors taking the test. In June 2022, the cfa institute reported that 14,776 candidates appeared from India, China, and the United States. The worldwide number was 71,914.

CFA test in India

Specialists in the business accept that the pattern is a consequence of the development found in the Indian economy. The nation has turned into a trustworthy speculation objective guaranteeing an expansion in venture experts.

The CFA Sanction expects contender to breeze through three test levels, have a work insight of something like four years in ventures, and focus on the set of principles in proficient lead. Following this, competitors are supposed to apply to a CFA Foundation Society and become an individual from the famous CFA Establishment.

The program educational plan tests abilities and information expected in the venture business. Considering that the worldwide market is changing at an exceptional speed, the CFA test guarantees premium expert lead, moral norms, and global fiscal summary examination. The Level I test especially tests competitors on their capacity to associate their hypothetical comprehension with training. They must demonstrate their capacity for real-time analysis of the investment industry. Other significant ideas incorporate corporate money, abundance the executives, portfolio examination, protections investigation and valuation, financial aspects and quantitative techniques.

Candidates typically need more than three years to successfully complete the CFA Program. Each of the three levels requires determination and a commitment to at least 300 hours of study.

The CFA tests are held across the world in excess of 70 urban communities in December and north of 170 urban areas in the long stretch of June. Test centers are assigned to candidates based on where they prefer to be.

India’s metropolitan areas of New Delhi, Bengaluru, Mumbai, and Kolkata saw the greatest number of Level 1 test takers in 2022.

IndigoLearn is among the global leaders in international training for CPA, CFA,CMA, ACCA, Data Science & Analytics. It has helped over 500,000 professionals across the globe. With IndigoLearn, 9 out of 10 students pass their exams.

Article Source: cfa preparation

#cfa level 1#cfa institute#cfa institute india#cfa program#cfa qualifications#cfa level 1 cost#cfa preparation#cfa online

2 notes

·

View notes

Text

The Wagner Affair: Russian Coup or Putin Chess Move?

Listening to Mainstream Media, one may get the impression that Vladimir Putin faces internal issues, on top of Global pressure from NATO. An ongoing dispute between Putin & Yevgeny Prigozhin regarding 'military tactics' in Ukraine led up to The Wagner Group breaking ranks w/ The Russian Army & marching on Moscow. They quickly crossed the border & commandeered strategic positions in Rostov- On- Don, a Russian City on the Southern Ukrainian Border. As fast as the news broke, reports of this 'mutiny' were changing.

New Reports now say that Wagner Troops were standing down & returning to Base. Meanwhile, Wagner Leader, Yevgeny Prigozhin has been 'exiled' to Belarus in a deal brokered by Belarusian President Aleksandr Lukashenko. The claims of Treason, & of a possible Russian Civil War are being downplayed. Secretary Of State Anthony Blinken paints a picture of a weakened Putin, but are there chinks in the Russian Armor? During this public 'spat' Vladimir Putin allowed Prigozhin to disseminate narratives on Social Media that were not only critical of his Defense Minister, but also critical of Putin's premise of NATO involvement & removing Nazis in Donbas.

News Analysts are saying that Prigozhin was making a Power Move on the Russian Military. Apparently, Prigozhin was against incorporating his Troops into the Regular Russian Army, so he made a play for Military Leadership. These Analysts question how Wagner Troops were able to get as close as 2 Hours away from Moscow, w/o internal help. Clayton Morris of 'Redacted' reported a coincidence regarding The Pentagon's $6.2B Valuation Error in Ukraine, less than 72 Hours before this 'mutiny'. He suggests a Maidan Style Revolt in Russia, orchestrated by NATO.

I assume the $6.2B was used to buy Players in this 'Coup'? Prigozhin is obvious, but I figure other Oligarchs were involved. Ukrainians are asking why the Mission was abandoned just a couple of hours later(?) In the 'Redacted' Newsstory, it is suggested that NATO was monitoring Prigozhin's Social Media activity, but Vladimir Putin anticipated this. Both Clayton Morris & Andrew Bustamante believe that the drama between Putin & Prigozhin was scripted. How else do you explain Putin letting a 'Traitor' & 'Backstabber' go into Exile- after abandoning him on the Battlefield? Vladimir Putin has pursued individuals Around The World for less.

Andrew Bustamante suggests that we're witnessing a redeployment of Wagner's 25,000 Soldiers to Belarus. They will join the 30,000 Regular Russian Soldiers already deployed there. Bustamante suggests they are poised for an assault on Kyiv. Belarus' Southern Border is not far from the Ukrainian Capital, & is accessible by Land & by River. I don't see why Putin would want to attack Kyiv; he always stressed the Donbas Region as his focus. Another Line of Thought is, Vladimir Putin manipulated Yevgeny Prigozhin's Social Media activity to determine Friend from Foe. NATO gets an illusion of a weak & fracturing Russia, while Putin gets to strengthen his weak spots.

As Time passes, it looks more & more like this 'Russian Coup' was some type of exercise. It was Over as fast as it Begun. Wagner Troops were initially ordered to return to their Mobile Base. We have to see if they're deployed to Belarus, to reunite w/ their 'exiled' Leader... Anthony Blinken made his rounds on the Sunday News Shows, painting a narrative of a toothless Russia collapsing on itself. What We keep discovering, is how Russia continues to stay at least one step ahead of America & NATO.

Regarding Yevgeny Prigozhin & the global operations of The Wagner Group, We have to see what happens. The West is anticipating the worst- Wagner Troops running amok in Afrika & Arabia, like Turks & Kazars. Is Prigozhin still in charge? I have some concern for the actions of Wagner Troops in Afrika, but Russia & Ukraine is an ancient argument that is None of My Business... I'm more interested in Poland's treatment of South Afrikan President, Cyril Ramaphosa, on his way to Kyiv- They would NEVER endanger a European Leader's Safety like they endangered President Ramaphosa's.

4 notes

·

View notes

Text

The Top Financial and Accounting Services Your Business Needs to Succeed

Running a business comes with numerous challenges, and managing finances and accounting can be daunting tasks for many entrepreneurs. However, with the right financial and accounting services, you can streamline your operations, ensure compliance, and make informed business decisions.

Here are the top financial and accounting services your business needs to succeed:

Bookkeeping and Accounting: This includes maintaining financial records, preparing financial statements, and managing accounts payable and receivable.

Tax Planning and Preparation: Tax planning ensures that you comply with tax laws, minimize tax liabilities, and make informed financial decisions. Tax preparation involves preparing and filing tax returns accurately and timely.

Payroll Management: Payroll management involves calculating and processing employee salaries, deductions, and benefits. It also ensures compliance with labor laws and regulations.

Financial Analysis and Reporting: Financial analysis and reporting provide insights into your business's financial health, performance, and trends. It helps you make informed business decisions and identify opportunities for growth.

CFO Services: Chief Financial Officer (CFO) services offer strategic financial planning, forecasting, budgeting, and analysis. It helps you manage financial risks and optimize your business's financial performance.

Audit and Assurance Services: Audit and assurance services provide an independent evaluation of your business's financial statements and internal controls. It ensures compliance with accounting standards and helps identify areas for improvement.

Business Valuation: Business valuation services help determine the value of your business, which is crucial for making informed decisions regarding mergers and acquisitions, selling the business, or securing funding.

Financial Planning and Analysis: Financial planning and analysis services help you plan and forecast your business's financial performance, identify potential risks and opportunities, and make strategic decisions.

Inventory Management: Inventory management services help you keep track of your inventory levels, costs, and profitability. It helps optimize your inventory levels and avoid stock-outs or overstocking.

Debt and Equity Financing: Debt and equity financing services help you secure funding for your business, whether it's through loans, lines of credit, or equity investments. It helps you manage cash flow, invest in growth, and finance capital expenditures.

By leveraging these financial and accounting services, you can streamline your operations, ensure compliance, and make informed business decisions. Whether you're a startup or an established business, partnering with a reputable financial and accounting services provider can help you achieve your goals and succeed in today's competitive market.

In conclusion, partnering with the right financial and accounting services provider can help your business thrive. At Truspanfinancial , Finance & Accounting Services, we offer a comprehensive suite of financial and accounting services tailored to your business needs. Contact us today to learn more about how we can help your business succeed.

2 notes

·

View notes

Text

Understanding Actuarial Valuation and End of Service Benefits

When it comes to financial planning and employee benefits, Actuarial Valuation and End of Service Benefit (EOSB) play crucial roles. Businesses must ensure that they have sufficient funds to meet their obligations toward employee gratuity, pensions, and other benefits. These financial calculations help organizations maintain financial stability while ensuring compliance with regulatory requirements.

In this blog, we will discuss the importance of actuarial valuation, its role in determining end of service benefits, and why businesses must seek professional actuarial consulting services.

What is Actuarial Valuation?

Actuarial Valuation is a mathematical and statistical process used to assess a company’s financial liability related to employee benefits. It helps organizations calculate the present and future financial obligations arising from employee-related benefits such as:

Gratuity

Pensions

Leave Encashment

End of Service Benefits (EOSB)

Other Long-Term Employee Benefits

Actuarial experts analyze different financial and demographic factors, including employee turnover rates, salary growth, inflation, and mortality rates, to estimate the liabilities accurately.

Why is Actuarial Valuation Important?

Regulatory Compliance – Many countries mandate companies to conduct actuarial valuations for employee benefits as per financial and labor laws.

Accurate Financial Planning – Helps businesses allocate funds appropriately to meet future obligations.

Transparent Accounting Practices – Ensures that companies follow proper financial reporting standards such as IFRS (International Financial Reporting Standards) and IAS 19 (Employee Benefits).

Risk Management – Identifies potential financial risks associated with employee liabilities.

Investor Confidence – Proper valuation boosts investor trust by showcasing sound financial management.

Understanding End of Service Benefit (EOSB)

End of Service Benefit (EOSB) is a compensation that employees receive when they leave an organization due to resignation, retirement, or termination. EOSB is particularly significant in the United Arab Emirates (UAE) and other Gulf Cooperation Council (GCC) countries, where gratuity laws govern employee benefits.

Key Factors Influencing EOSB Calculation

Length of Service – Employees who work for a longer duration receive higher EOSB amounts.

Final Salary – EOSB is often based on the last drawn salary of the employee.

Reason for Termination – The EOSB amount varies depending on whether an employee resigns or is terminated.

Local Labor Laws – Countries have different rules governing EOSB calculations.

EOSB Calculation in the UAE

In the UAE, EOSB is calculated based on the UAE Labor Law, which defines gratuity payments for employees.

For Employees Who Have Completed More Than One Year of Service:

First 5 years of service: Employees receive 21 days' basic salary per year.

Beyond 5 years of service: Employees receive 30 days' basic salary per year for each additional year.

Total EOSB should not exceed two years' worth of salary.

For Employees Who Resign Voluntarily:

If service duration is less than 1 year, no EOSB is payable.

If service duration is between 1-3 years, employees receive one-third of the EOSB.

If service duration is between 3-5 years, employees receive two-thirds of the EOSB.

If service duration is more than 5 years, employees receive full EOSB entitlement.

The Role of Actuarial Valuation in EOSB Calculation

Since End of Service Benefits represent a significant financial liability for companies, businesses must conduct Actuarial Valuation to estimate the EOSB liability.

How Actuarial Valuation Helps in EOSB Management?

Accurate Liability Estimation – Helps organizations determine the exact financial obligation toward EOSB payments.

Strategic Financial Planning – Ensures that companies allocate sufficient funds for EOSB liabilities.

Compliance with Accounting Standards – Businesses can align their financial reporting with IAS 19 and other international standards.

Risk Mitigation – Helps in forecasting future liabilities and potential risks.

Fair Employee Compensation – Ensures that employees receive their rightful benefits as per labor laws.

Why Companies Should Opt for Professional Actuarial Valuation Services?

Given the complexity of Actuarial Valuation and EOSB calculations, companies must engage professional actuarial consultants like Mithras Consultants.

Key Benefits of Hiring Actuarial Experts

✔ Expertise in Employee Benefits Accounting – Actuarial consultants specialize in evaluating liabilities for employee benefits. ✔ Compliance with Global Standards – Ensures compliance with IFRS, IAS 19, and local labor laws. ✔ Accurate Financial Forecasting – Helps in long-term financial planning and risk assessment. ✔ Customized Solutions – Offers tailored valuation reports based on company size and industry. ✔ Seamless Audit Process – Ensures smooth audits and financial reporting.

How to Conduct Actuarial Valuation for EOSB?

Organizations should follow these steps for actuarial valuation of End of Service Benefits:

1. Collect Employee Data

Employee’s date of joining

Salary details

Expected retirement age

Resignation and termination history

2. Select an Actuarial Method

The Projected Unit Credit (PUC) Method is widely used for EOSB actuarial valuation. This method considers future salary increments and employee attrition rates.

3. Make Assumptions for Future Projections

Expected salary growth

Employee turnover rates

Discount rate (for present value calculation)

Inflation rate

4. Conduct Valuation Analysis

Using actuarial formulas, experts calculate the present value of EOSB liability based on financial and demographic assumptions.

5. Prepare an Actuarial Report

A detailed report is provided, including liability projections, risk assessments, and funding recommendations.

Conclusion

Actuarial Valuation plays a critical role in financial planning for End of Service Benefits. By conducting periodic valuations, businesses can ensure they meet their employee benefit obligations while maintaining financial stability.

For companies looking for professional actuarial services, Mithras Consultants offers expert solutions for EOSB actuarial valuation, gratuity calculations, and employee benefits planning.

Stay financially prepared and compliant with Actuarial Valuation for EOSB today!

0 notes

Text

Navigating Global Trade: The Significance of Import Declarations in Supply Chain Management

In the intricate web of international commerce, import declarations stand as crucial documentation that shapes the movement of goods across borders. As businesses engage in cross-border trade, adherence to import declaration requirements becomes paramount, ensuring compliance with regulations while facilitating the smooth flow of goods. This article delves into the significance of import declarations in supply chain management, exploring their role, challenges, and the evolving landscape of compliance.

Understanding Import Declarations:

An import declaration is a formal document submitted to customs authorities, providing essential information about goods being imported into a country. This document typically includes details such as the nature and quantity of goods, their declared value, country of origin, and intended use. Import declarations serve multiple purposes, including regulatory compliance, duty assessment, and statistical analysis of trade flows.

Role in Supply Chain Management:

Import declarations play a central role in supply chain management by ensuring transparency, compliance, and efficiency in cross-border trade processes. Key functions and benefits include:

Regulatory Compliance: Import declarations help businesses comply with import regulations imposed by customs authorities, including tariff classifications, valuation rules, and import licensing requirements. By accurately documenting the characteristics of imported goods, businesses mitigate the risk of non-compliance and associated penalties or delays.

Duty Assessment: Customs authorities utilize import declarations to assess applicable duties, taxes, and fees on imported goods. Accurate declaration of the goods' value and classification is essential for determining the correct duty rates and avoiding overpayment or underpayment of duties.

Risk Management: Import declarations enable customs authorities to conduct risk assessments and target high-risk shipments for inspection or additional scrutiny. By providing detailed information about the goods and their associated risks, import declarations contribute to enhanced border security and the prevention of illicit trade activities.

Supply Chain Visibility: Timely submission of import declarations facilitates the visibility of goods throughout the supply chain. By tracking the status of import declarations and associated clearance processes, businesses gain insights into shipment progress, potential delays, and estimated delivery times, enabling proactive supply chain management.

Challenges and Considerations:

Despite their importance, import declarations present challenges and complexities for businesses engaged in international trade:

Data Accuracy and Integrity: Ensuring the accuracy and integrity of import declaration data can be challenging, particularly when dealing with diverse product categories, complex supply chains, and varying regulatory requirements across countries. Errors or discrepancies in declaration information can lead to delays in clearance processes and regulatory non-compliance.

Regulatory Changes: The regulatory landscape governing import declarations is dynamic, with frequent updates and changes in import regulations, tariff schedules, and trade agreements. Staying abreast of these regulatory changes and adapting import declaration processes accordingly is essential for maintaining compliance and minimizing disruptions to supply chain operations.

Customs Automation and Integration: Many countries are transitioning to electronic customs systems and automated clearance procedures, necessitating the adoption of digital solutions for import declaration submission and processing. Businesses must invest in compatible technology platforms and ensure seamless integration with customs authorities' electronic systems to facilitate efficient clearance processes.

The Future of Import Declarations:

As global trade continues to evolve, the future of import declarations lies in digitalization, automation, and collaboration among stakeholders. Emerging technologies such as artificial intelligence, blockchain, and data analytics hold the potential to revolutionize import declaration processes by enhancing data accuracy, streamlining clearance procedures, and enabling real-time risk assessment. There are many import declarations services providers in the market but Customs Declarations UK is of the trusted and reliable one with good reviews.

Furthermore, increased cooperation and information sharing among customs authorities, businesses, and technology providers can foster interoperability and standardization of import declaration processes on a global scale. By leveraging shared platforms and data exchange mechanisms, stakeholders can achieve greater efficiency, transparency, and compliance in cross-border trade operations.

Conclusion:

In conclusion, import declarations play a vital role in facilitating international trade and supply chain management. By providing accurate and comprehensive information about imported goods, import declarations enable regulatory compliance, duty assessment, and risk management in cross-border transactions. As businesses navigate the complexities of global trade, embracing digitalization, staying informed about regulatory changes, and fostering collaboration with customs authorities are essential strategies for optimizing import declaration processes and ensuring seamless supply chain operations.

Author Profile:

(David Hawk)

David Hawk is an Expert in Customs Declarations Services having 7+ years of experience in this industry.

#GlobalTrade#ImportDeclarations#SupplyChainManagement#CustomsCompliance#InternationalBusiness#TradeLogistics#DigitalTransformation#CustomsAutomation#GlobalCommerce#TradeEfficiency#AIInTrade#BlockchainInSupplyChain#RegulatoryCompliance#TradeTransparency#RiskManagement

0 notes

Photo

Ever wondered how the value of the Indian Rupee (INR) fluctuates against other currencies like the US dollar or the Euro? Understanding the forces that shape the INR’s exchange rate can be incredibly valuable. This article will demystify “How Indian Currency Value is Determined”, providing a clear and easy-to-understand explanation of the factors influencing our Rupee’s strength – or weakness – in the global financial market. We’ll explore the complex interplay of economic indicators, global events, and government policies that all come together to determine the daily rate you see when converting currencies. Let’s dive into the world of exchange rates and learn exactly what affects the fluctuating price of our Indian Rupee.

How the Value of the Indian Rupee is Determined: A Comprehensive Guide

The value of the Indian Rupee isn’t fixed; it constantly changes based on various economic happenings both within India and globally. This constant fluctuation makes understanding the determinants crucial for businesses, international travelers, and anyone dealing with foreign currency. So let’s break this down.

The Role of Supply and Demand

The most fundamental factor influencing any currency’s value, including the INR, is good old-fashioned supply and demand. Think of it like any other market. When demand for the Rupee increases (more people want to buy rupees), its value goes up. Conversely, if the supply of rupees increases (people selling rupees outnumber those buying), its value tends to fall.

What increases demand for INR?

Foreign investment into India: When foreign companies invest or take stakes in Indian companies or buy Indian assets, they need to exchange their currency for INR—driving up Rupee demand.

Tourism: International tourists visiting India exchange their currency for rupees, fueling demand.

Exports: When India exports goods and services, it receives payments in foreign currencies. These subsequently get converted back into rupees, contributing to stronger Rupee.

Remittances from Indians abroad: Money sent home by overseas Indians boosts the supply of foreign currency and naturally raises the rupee demand as it’s sold for Indian currency.

What increases supply of INR?

Imports: When we buy products and services from overseas sources (as in many technology-driven industries that depend on global supply chains*), the demand for foreign currencies boosts the supply of domestically available Indian currency in the foreign exchange market in order meet these obligations and so lowers the Rupee values temporarily.

*[link to article explaining India’s global participation in tech or a similarly related industry]

Foreign investment outflow: If global political and financial developments convince foreign investors their interests may be poorly managed to meet certain concerns(economic uncertainty may decrease returns, and so, investors choose to lessen that risk via withdrawing some or all investment.) which increases the supply locally available in order obtain other competitive ventures.

Outbound tourism from India: When Indians make tours outside, it necessitates exchanging rupees (into foreign currencies)– which ultimately pushes up the supply pushing the exchange rate of Rupee downwards.

Macroeconomic Factors at Play

Beyond simple supply and demand, numerous financial policies and trends underpin a currency’s value. This usually depends on both external financial forces plus internal influences directly attributable to a nation’s local fiscal strategy itself as explained by macro-economics:

Interest Rates set by the RBI (Reserve Bank of India)

The Reserve Bank of India’s (RBI) monetary policy directly plays vital roles for the value-rate valuation for Rupee as affected indirectly whenever there may become changes within an economy due this bank deciding upon an action-strategy whether increasing lowering otherwise changing a prevailing system regarding these rates themselves or what level might suit given this specific monetary-period cycle; it is determined in reaction whatever factors which arise based upon how economic cycles flow along themselves including inflation rates too

Higher interest rates: Often attract foreign investment, as investors aim for higher returns. So consequently therefore increases exchange demand of INR.

Lower interest rates: May entice investors to invest elsewhere with greater competitive interests yields— thus correspondingly reduce valuation downward as overall financial movement transfers outside a given currency locale.

Inflation

High inflation rates make the overall internal value for a country to be lowered thus impacting overall confidence held against investing currency whether locally and foreign sources where else; as it eats savings/returns rates through time– eventually causing lower purchase value rates in turn.

Controlling Inflation: To combat inflation it increases short term credit cost rates charged by central reserve banking facilities while reducing supply thereby encouraging fewer circulating purchasing operations therefore counteracting high monetary flows in supply.

Fiscal Policies

The government budget decisions — spending plans, taxation decisions, all influence INR. These variables change investor faith with respect market stability therefore whether INR trades at competitively strong trading rates then become altered dependently whether policy changes seen favorably or unfavorably interpreted accordingly investors.